By now, you’ve surely seen Rivian’s big news. The EV manufacturer best known for its $70,000 R1 pickup truck revealed not one, but three new vehicles to expand its line. They include the R2, an SUV that starts around $45,000, and the R3 and R3X, a cheaper pair of crossover hatchbacks inspired by rallycross racing. (Read my full feature here, and more specific design details on the vehicles here.)

Weeks before the reveal, I traveled to the company’s headquarters in Irvine, California, to spend a few uninterrupted hours with CEO RJ Scaringe, ahead of this make-or-break moment for his company (which currently loses around $30,000 on every R1 it sells). Before we toured clay-model mockups and studied the interiors in augmented reality, we went deep into everything else: namely, how Rivian plans to respond to growing consumer apathy around EVs.

I’ve presented the longform interview below with light editing to preserve Scaringe’s point-of-view.

You’ve teased the R2 for years as the model that would drive adoption for Rivian. Now it’s here. This feels like the make-or-break product for the company.

Since the product portfolio and product plan was conceived, we’ve always thought about R1 as the brand-building product; it sort of establishes who we are. But R2, really being the product that allows us to create scale as a company, would, implicitly be or inherently be, the product that makes or breaks the company. Without it, we would not be able to achieve the level of impact that we’re working hard to drive. So, it is absolutely the focus for the business. And it’s necessary for us to achieve our targets.

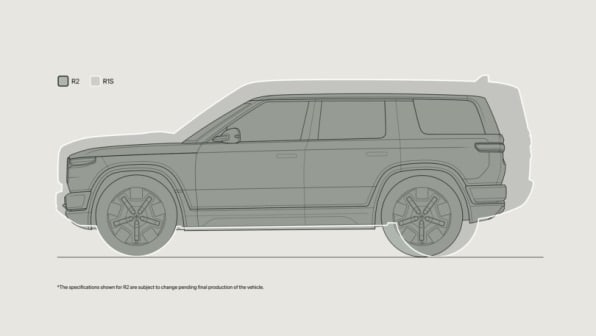

Seeing the R2 for the first time, it felt remarkably similar to the R1. Of course it’s smaller, but without seeing them side by side, I’d have to do a double take to know the difference. It feels less like a line expansion to me than that you took your original product and figured out how to make it less expensive.

We launched the R1, and the goal of the original product was to establish the brand. The primary purpose was to take something that didn’t mean anything to anyone really, at that time—what is a Rivian?—and give it some definition or some meaning.

We talked a lot about the idea of enabling and inspiring customers to take on adventures—to do the kinds of things they want to take photographs of. And that was like the ethereal drive to make this thing that would allow you to go do stuff that might scare you, whether it’s hiking, or biking, or taking a telescope out to an open field, or going and visiting your friends across state. And, amazingly, that connected really well. And as we looked at the R2 and R3, our idea was taking that brand concept and stretching it into different price segments [and] into different form factors.

With R2, we want to maintain and capture the core essence of the vehicle. We really wanted to capture that core essence of fitting a lot of stuff—your pets, your gear, your kids, your friends, your things—into a shape that is really a two-box shape. So it gives you that space in the back behind the second row, and really captures the imagination of a vehicle you can go have an adventure in. It has that sort of proper stance of an SUV.

With R3, we really stretched the definition. We wanted to demonstrate the elasticity of the brand and show how Rivian’s brand can apply to . . . this smaller crossover. It’s sportier and more car-like as well.

I imagine a lot of people who wanted an R1 but couldn’t afford it will say the R2 feels pretty close, whereas the R3 may attract a different buyer.

We had a huge amount of debate as to how far R2 wanted to pull [from R1]. And for that matter, should R3 come before R2, or should R2 come before R3? You can imagine, more than one conversation happened on that. We decided on R2 as the immediate follow-up to R1 because so many people aspire to the idea of what an R1S represents.

I 100% get that aspirational aspect of the brand. I see the appetite. I don’t know how large it is. But I can see it.

People who buy a Rivian often end up joining a review club or owners forum and then find themselves on the trail. It expands your horizons. It’s crazy. All these things we talked about in 2017, 2018. We were like, “man, we would love it if user groups formed and people would go off and explore together.” And all that has happened. It’s this beautiful foundation for us to launch R2 into—recognizing most of the time that vehicles are not doing that. Most of the time, they’re picking people up from running errands, they’re driving to the office; but the aspiration of the product and the brand has really informed its soul and personality.

The cheaper R2 is something you’ve alluded to for years in interviews, and we’re still a couple years from seeing it on the road. Why was actualizing it so difficult?

It relates less directly to R2 than the overall business.

I started the company in 2009. We had one employee, who was me, but no capital. No engineering team, no technology, no brand, no manufacturing infrastructure, no facilities. To develop a product you need capital, and to get in capital, you need a product. And what I thought would take a couple of years ended up taking us from 2009 until we launched in 2021. And then when we launched R1, we didn’t just launch one vehicle, we launched the R1T, the R1S, and two different variants of our commercial van.

We launched into this incredibly challenging operating environment with the pandemic. The first pieces of equipment for our plant in Illinois started showing up—I mean, you can’t make this up—in February of 2020. Just like the worst time possible to be putting together a multibillion-dollar construction project. We muscled through that and launched in 2021.

Then we had the supply chain challenge. And so the first year-and-a-half post-launch—call it all 2022 through the early stages of 2023—we were just fighting tooth and nail to get enough parts across all those different vehicles to actually ramp production. This business is so fixed-cost heavy. So if you’re not running at the appropriate volume levels, all the unit economics look terrible. It’s very hard to make money at low volumes.

The nature of launching a vehicle is you’ve got thousands of parts coming together from hundreds of suppliers. If you look at the number of discrete components in something like an R1S, there’s around 30,000. It’s really madness! While there are only 3,000 parts that we personally assemble, if any single one of those 30,000 components are off—and it could be the smallest semiconductor—it stops the whole system.

It absorbed a tremendous amount of organizational focus and bandwidth to get our Normal, IL, plant running smoothly. But as all that was happening, it actually afforded us the opportunity to iterate on R2 a few more times. Because if we’d gone immediately from R1 right into R2, without the chance to have the longer iteration loops, we would have had less time to really get the concept of the vehicle dialed in.

If you were to look at an R2 from two years ago to what is going into production now, the proportions just became sweeter. It wasn’t as clean. It wasn’t as tight. It wasn’t as tidy in its dimensions. Dialing up this the level of refinement was facilitated by the fact that we weren’t in a position to go fast on the next production.

So you knew if you couldn’t put R2 into production anyway, you might as well spend more time designing it?

That’s exactly what happened.

And then we had the opportunity to take a lot of the technology that’s going into R2, particularly on the electronic side and software, and put a lot of that into R1 going forward.

So you’re gradually updating R1 with some of R2’s cheaper guts?

Specifically on electronics, yes, and semiconductors. We do all of our electronics and software stack in-house. It essentially de-risks R2, but it also allows us to take a lot of cost out of R1 over the next couple of years. And it allows us to make sure that when we launch R2, it is out of the gate ready to go really high volume very quickly.

The R2 isn’t coming out for two years; the R3 after that. But you’re losing about $30,000 on every R1 sold. Even if the R2 is a hit, how does the business sustain itself until then?

We are absolutely laser-focused on also delivering R1 profitability. We are working to achieve R1 profitability this year. And its profitability will continue to grow over time as more and more cost improvements are achieved.

With that said, we want R2 to launching into an environment where we’ve demonstrated now, quarter over quarter over quarter, continuous profitability and progress on our cost structure. But it’s really R2 that allows us to step up in terms of volume, and therefore achieve some of the really larger scale efficiencies that come with running the business; everything from fully utilizing our service network, our go-to market infrastructure, and there’s sourcing advantages to having more volume on our platform—particularly for items that have common suppliers. So there’s a host of real advantages that come from the scale that more lower priced R2 products will achieve.

The R2 volume allows us to negotiate—prior to launch of R2—cost-downs on R1. So there’s certainly still economies of scale there. Some of the big savings we’re gonna see on R1 over the course of the 2nd quarter…those are all negotiated largely on the basis of R1. Then there’s further cost breaks that occur as we introduce more volume with R2. So the business gets a virtuous positive reinforcement. Where we get more scale with R2, it drives not only the top line revenue, but also drives improved costs…across both R1 and R2.

You talked about launching the R1 at the worst possible time, given the pandemic. I feel like you could almost say the same about launching R2 at a time when we’re seeing this incredible consumer apathy toward EVs. Whether it’s sluggish sales, renewed range anxiety, or stories about EVs losing half their range in Chicago this winter. That apathy was the curveball I didn’t see coming six months ago.

So I think this topic has a lot of misplaced causality in how we’re thinking about the path to 100% of vehicles being sold being electric.

The rate at which electrified vehicle sales is growing is a slowing rate. Now, it’s worth noting that it’s continuing to grow; we’re continuing to sell more electric vehicles year-over-year. So there is positive growth, it’s just not as fast as we expected or not as fast as it was.

Rivian had a dip in the vehicles you sold in Q4 2023 from Q3. You don’t think that’s a trend line that will continue?

That’s idiosyncratic for us based upon van production. Amazon takes very few deliveries [of vans] then because that’s their busy season. So we build a lot of inventory, and then we deliver them in Q1 or Q2.

But I’d say broadly as an industry, what’s happening is we don’t have enough choice. I think the causality we miss is there are very few great EV choices, particularly at price points that are broadly relevant.

Tesla Model Y is a great choice. Tesla Model 3 is a great choice. And then there’s a pretty big drop off. There’s maybe a few other choices, but there’s nothing that’s a deeply compelling product. And I think the products that have come to market, many of them try too hard to emulate Tesla, so the form factor or the silhouette or the seating configuration or the vehicle attributes are very similar to a Tesla Model Y.

And you can understand how that was arrived at because of the success of Model Y. But I think what we’ve seen happen is customers have had to exercise a lot of form factor and vehicle attribute elasticity. Meaning, I wanted an SUV, or I wanted a minivan, or I wanted a hatchback—I wanted something else!—but I’m going to go get a Model Y because there’s no other good choice in the form factor. And so I think we’re starting to see some saturation in just how many people are willing to get a Model Y or a Model 3.

So you’re saying people have to spend too much on an EV to compromise?

It’s just compromising because you maybe you wanted something else. There are more than 300 vehicle choices in the ICE world. And you have far fewer in the EV world. And of those that are there, I’d say only a subset of them are really strong and well-developed.

I think the unlock for electrification is that many things are going to drive it: charging infrastructure plays a role…interface plays a role. But I think the above and beyond that, the most important element is customers need to have a choice, then there needs to be more than one or two great choices available to customers to choose from.

The competition as we think about it is not, for every Rivian R2 that’s sold ther is one less Model Y being sold. We want to be creating new EV customers—pulling people that are in the 90+% of non-EV customers into EVs.

That’s a common point of view for anybody working in a new sector—before there’s scale, your competition is really your friend in a weird way.

Totally! So with R1, the perception is always that our success requires Tesla to sell less. Most of our customers have never owned an EV before. So we’re not, like, taking people out of a Model S or Model X and putting them into an R1. That may happen! But the vast majority of our customers are trading out of some type of ICE vehicle.

I believe that’s [going to be] even more true in the R2 segment, when you’re in that $45,000 to $50,000 price range. There’s a lot of customers who are buying midsize SUVs, midsize crossovers, who are looking for something that’s electric and they just don’t have a good choice.

There’s the Hyundai Ioniq, and a few newer products in that space.

In that price point you see a number of things, but the things we’re targeting in terms of attributes, features, the design thoughtfulness that goes into usability for everyday adventures and the sort of the aspirational adventures that’s embodied in R2…we don’t think there’s a lot of that out there.

Certainly having more options, especially in popular SUVs, is beneficial. But I’m still not sure I’d say EVs are purely facing the issue of customer choice and selection.

Unfortunately, sustainability has become far more politicized than I think anybody ever imagined—certainly myself—and far more politicized in our country than almost any other developed economy around the world. And that polarization, the fact that sustainable businesses and sustainable ways of living has become politicized, has led to electric vehicles becoming part of that. It’s deeply unfortunate. We try really hard to make it clear that our customers can come from anywhere across the political spectrum. The products themselves are exciting; they deliver great, great value.

I think the media in general has become part of that echo chamber. The best example I have of this is the cold weather that we had a few weeks ago. People said, oh, you can’t drive an electric vehicle when it gets cold. Two really important things: one is batteries. A design criteria on batteries is how well they perform in a cold temperature. So not all batteries are created in the same way, [just like] not all engines are the same. A four cylinder and a V8 aren’t the same thing.

You can design your batteries to perform extremely well at low temperature. But it’s a decision, and you have to put cost into the chemistry to have high performance. So that’s point number one. There’s the assumption every EV is the same. A big element of consumer education is how well does this vehicle perform in cold weather. It’s gonna be brand specific.

You’re saying a Rivian won’t lose 40% of its charge in a cold snap?

Any battery chemistry is going to degrade, but it can degrade very differently. Some can perform much better at low temperatures. For us, it’s one of our most important design criteria.

What was your second point about the media driving poor EV perception?

There were a lot of stories [out of the January cold snap] about electric vehicles not working. There are no stories about all the regular ICE vehicles that didn’t start. So case in point: I got a customer photograph from a ski resort. And it’s a picture of all these cars, and they’re all dead. And he says, “I’m the only car that could drive out.” And he’s in a Rivian, of course.

Every ICE vehicle can’t start because the batteries are all dead, but obviously the Rivian drove out without breaking a sweat! So I think It was unfortunate to see such highly biased coverage of that. But the reality is, when it’s negative 25 degrees out, you’re gonna have ICE vehicles that won’t start and you’re gonna have different types of EVs, depending on the configuration, that won’t start. It’s almost like Big Oil funded all these articles to come out just to create this negative perception of EVs in cold weather.

I would agree that working in the media there is a phenomenon where things can get knocked off their pedestal, and there can be a lack of nuance there. But I would also say that topics like EV range in cold weather, or how self-driving handles snow and ice, are two topics I was worried about 10 years ago! People developing these cars were often doing it in California. Waymo tested first in Arizona. These are vastly different worlds from your typical Midwest winter—and dealing with cold weather is a core design problem here.

But see, that nuance is really hard to communicate. I don’t actually know the answer. [EVs create] a whole new set of constraints that people aren’t used to. You know, another one that’s a big fear is fires—that electric vehicles are going to have more fires. There’s way more fires that are caused by combustion powered vehicles!

You’re saying there are more fires in a car that literally explodes to move?!?

Yeah! [laughs] But there’s just these locked-in perceptions around electrification that I think will take time to solve.

We still need to address range anxiety. The failure of Electrify America to build a promised coast-to-coast network of charging stations is a real blow to EV adoption.

To me, it’s a design problem with the infrastructure that becomes hard for you to reconcile with any new vehicle. You can put a bigger battery into your car, but then it gets too heavy and too expensive. And so it feels like any company in this space almost has to address the infrastructure, like Tesla began to with its Supercharger network.

What’s Rivian’s role here?

In general, we’ve seen far less investment in charging infrastructure than I would have ever imagined. If I rewind the clock back six years, I would have said somewhat emphatically that there’s going to be a lot of investment that’s going to start to pour into the energy infrastructure. We’re going to see the incumbent businesses that have been part of the fuel supply chain start to invest in sustainable, renewably-powered charging infrastructure. And I would have been, like, deeply convicted in that view. And unfortunately, I would have been wrong.

We’ve seen massive under investment in the space. The largest network to date [Electrify America] is one that’s been required by court mandate because of an emission scandal. And as a result, that the resulting network is subpar at best, both in terms of the location of those of those charging stations, and the efficacy of them, meaning the uptime is very low. And that’s the biggest network outside of Tesla.

We started to see, probably four years ago, that there’s gonna be this massive gap, so we started to design our own in-house charging infrastructure. In much the same way that Tesla built out Supercharger, we started designing all the hardware and all the electronics and the platforms to enable what we now call Rivian Adventure Network. We’re now building it. I think it’s about 65 stations. So it’s roughly 4% the size of Tesla’s network. But the important statistic is the uptime on it, which is really the measure of the network and the effectiveness. The hardware is on very similar levels with Tesla, so 97-98% uptime, which is world’s better than where you see with any other network.

We launched with a closed network, so it’s just for Rivian vehicles. This summer, we’ll be opening that up. And then we hope to expand that dramatically. In parallel we have a relationship with Tesla that will soon allow customers to use their network. But just as importantly, we’ll allow Teslas and other non-Rivians to use ours, which gives us the scale to allow that network to get to profitability really quickly, and it enables us to invest heavily in it.

Perhaps the most frustrating thing when you’re on a longer trip in an EV is to go to a charging station and none of the chargers work. And so we purchased a company last year that gives us tremendous amounts of data around the efficacy of all these different charging stations as measured across all these different users. It creates an important view for us to put into our mapping algorithms and into our vehicle.

It’s a classic chicken-and-the-egg because there’s not enough electric vehicles to warrant people to invest in charging infrastructure. There’s not enough charging infrastructure to sort of facilitate the complete shift towards electrification. But the end state is clear: It’s going to be there. And what I’m just shocked by is that the incumbent, very profitable oil and gas business didn’t look at this as an investment opportunity. I just don’t understand why they’re not doing that.

I think the flip side of this coin is that you have California mandates that say cars have to be electric 2035. So there’s this future state that’s very certain but also a ways off. I’m curious how much that influences your thinking, and I hate to say, general confidence in running an EV company today.

There’s two sides of this, which need to converge at the same moment. There’s policy: In most of the world, there’s regulation and policies for all new vehicles to be electric by sometime between 2030 and 2040. Most countries are 2035 (like California). And then there’s the consumer demand. And if I were to take a snapshot of what the world looks like today, the 2035 policy of all new vehicle sales being electric would be really hard to achieve.

Because [as I mentioned earlier] we don’t have choice, and essentially everybody would be buying one of a handful of different vehicles. What it means is that companies, ourselves included, need to create a beautiful mosaic of choices that have different attribute trade offs, different form factors, different price points over the next 10 years.

If history has taught us anything, consumers like choice. If we were purely economic optimizing machines, we’d all be wearing white t-shirts and gray pants. But I think the reality is that people like to express themselves, they want products to speak to them. So I think in the vehicle world, we have a similar necessity.

The policy’s there. The companies that are operating in the space need to go create products that make that policy possible. And I think 10 years from now, it is really realistic. But it is remarkably close.

I drive a Rav 4, the most popular SUV in the US—and I’m not sure I could afford your R2 or R3. And if I look at the perfect vehicle for myself today, with a minimal commute, it’d be a plug-in hybrid where I can get 40 miles and almost never use gas.

Which makes me wonder, especially as you eye European markets and more urban living, would you go even lower in price and range?

As you say, the vehicle and the ecosystem in which it operates need to be coordinated. And the ecosystem, which we’re launching R2 into, is a system in which charging is not yet ubiquitous. And we’re still continuing to build our brand. We’ve decided with R2 and R3 to launch a set of products that have significant range with large batteries.

But as we think about the overall transportation system [in] the United States, we’re absolutely going to need to have vehicles that are smaller, lower priced, lower range, where your vehicle has, let’s call it, I don’t know, 140 to 160 miles of range. That’s not what we’re building. Whether or not Rivian builds that someday in the future, I don’t know. But as a set of choices for consumers, there will be an opportunity for that product. To get to 100% electric vehicles of new vehicle sales being electric, we’re going to have to have vehicles that start at very low price points.

I do trust all the ideas youve presented in your post They are really convincing and will definitely work Nonetheless the posts are too short for newbies May just you please lengthen them a bit from next time Thank you for the post